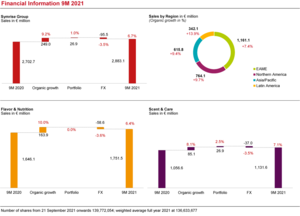

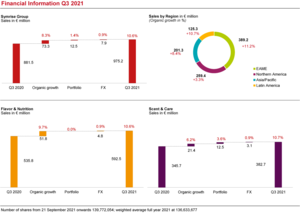

Symrise AG successfully continued its profitable growth course in the third quarter of 2021. The Group recorded excellent organic sales growth of 8.3 %. In the first nine months of the current financial year, growth even amounted to 9.2 %. Taking into account the portfolio effect from the acquired fragrances business of Sensient as well as currency translation effects, Group sales rose to € 2,883 million during the reporting period (9M 2020: € 2,703 million), up 6.7 % compared to the prior-year period and 10.6 % in the third quarter. Both segments contributed to this positive result.

“We can look back on an exceptionally successful third quarter of 2021. As a result of the progress made in battling the coronavirus pandemic, demand has continued to increase significantly. The demand was particularly high for applications associated with more travel or leisure activities – including, for example, sun protection products, fragrances, but also applications for beverages and culinary products. We are extremely satisfied with our business development since the beginning of the year and we are continuing our accelerated growth path,” said Dr Heinz-Jürgen Bertram, CEO of Symrise AG. “This is why we are once again raising our sales forecast to around 9 %. We are confident that we can achieve even more growth than forecasted after six-months and we will make the best possible use of the remaining weeks in 2021 to achieve this target.”

Scent & Care with strong sales growth in Fine Fragrances, Active Cosmetic Ingredients and Menthol

Scent & Care, the business with fragrances, aroma molecules and cosmetic ingredients, achieved strong organic sales growth of 8.1 % in the first nine months and 6.2 % in the third quarter of 2021. Taking currency translation effects into account, sales amounted to € 1,132 million in the reporting period (9M 2020: € 1,057 million). The fragrance business acquired from Sensient in April 2021 contributed a total of € 27 million to the segment’s sales.

The Fragrance division benefited in particular from strong demand in the application area luxury perfumes, driven by the resumption of international travel and normalization of consumer demand following the end of lockdowns in many countries. The Fine Fragrances business achieved an excellent double-digit sales growth in all regions. The Consumer Fragrance and Oral Care business units also developed well, once again increasing sales compared to the exceptionally high levels of the previous year. Both generated organic growth in the single-digit range. Overall, the Fragrance division achieved good, single-digit percentage organic growth with sales increases in all regions.

The strong demand for aroma chemicals and in the Menthol business unit led to good sales development in the Aroma Molecules division. The highest growth was achieved in the Asia/Pacific and EAME (Europe, Africa, Middle East) regions. The Menthol business unit recorded double-digit percentage growth on the back of continuing strong demand and successful capacity expansions. Overall, sales in the Aroma Molecules division increased organically in the middle single-digit range in the first nine months and in the double-digit range in the third quarter.

Growth in the Scent & Care segment was particularly driven by the Cosmetic Ingredients division, which also benefited from increased travel activity and the demand for high-quality cosmetic products. The high demand for sun protection products and products with active cosmetic ingredients led to strong organic growth. The regions of North America and EAME, in particular the national markets USA, Canada and France, underwent particularly expansive development. Overall, the division achieved strong double-digit organic sales growth in the first nine months and further accelerated growth in the third quarter.

Applications for beverages and pet food drive strong sales growth for Flavor & Nutrition segment

The Flavor & Nutrition segment increased organic sales by a strong 10.0 % compared to the previous year. In the third quarter, organic growth amounted to 9.7 %. Taking currency translation effects into account, segment sales increased to € 1,752 million (9M 2020: € 1,646 million). Flavor & Nutrition also saw a normalization of consumer behavior owing to progress in combatting the coronavirus pandemic. The increase in out-of-home consumption exerted a positive impact and led to strong demand for beverages. At the same time, the increasing number of households with pets across the world generated high demand for pet food applications, resulting in strong growth in this business unit.

Applications for beverages recorded sales growth in the double-digit range. In all markets, growth was particularly driven by the strong increase in demand for beverages destined for out-of-home consumption.

Sales in the Savory business unit in all regions slightly exceeded the exceptionally high prior-year level, which was characterized by the particularly high demand during the initial months of the coronavirus pandemic.

Sales for sweet product solutions were slightly below the prior-year level. Medium single-digit growth driven by new customers in Latin America and Asia/Pacific was offset by the current low price level for vanilla.

The Pet Food business unit continued its strong growth compared to the already excellent prior-year period and increased sales in the double-digit percentage range. The sales development was particularly dynamic in the national markets of Mexico, Russia and South America.

The Food business unit achieved modest organic growth. This was driven by rising sales in Western Europe, while sales in North America declined slightly.

The ADF/IDF Group also developed extremely well, achieving double-digit organic sales growth. The business recorded strong growth in its home market, the American domestic market.

The Probiotics business unit, including the majority shareholding in the Swedish company Probi AB, did not maintain the strong level of the previous year and recorded a slight decline in sales. This is balanced by strong project vitality with numerous new product launches of customers.

Symrise once again raises its sales forecast for 2021

With its global presence, the continually growing, diversified portfolio and its broad customer base, Symrise considers itself as being robustly positioned despite the ongoing challenging market environment. Symrise has full delivery capability and can reliably meet the strongly rising demand in the wake of successful combatting of the coronavirus pandemic.

Based on the positive business development in the first nine months, Symrise is once again raising the sales target and now expects organic growth of around 9 % for the full year 2021. This corresponds to an increase of around two percentage points compared to the raised forecast of 7 % in August 2021. Symrise thereby highlights its aspiration to once again significantly outperform growth in the relevant market for fragrances and flavors during the current financial year. In the present business environment, current estimates assume market growth of 3 to 4 %.

Furthermore, Symrise is adhering to its profitability target for the financial year 2021 and is aiming for an EBITDA margin of more than 21 %.

The medium-term targets continue to be unchanged. The company expects to increase its sales to between € 5.5 and € 6.0 billion by the end of the financial year 2025. Symrise intends to achieve this increase with annual organic growth of 5 to 7 % (CAGR) and complementary strategic acquisitions. Profitability over the medium term is projected in the target corridor of 20 to 23 %.

Financial calendar 2022

1 March

Full Year Results 2021

27 April

Interim Group Report January-March 2022

11 May

Annual General Meeting