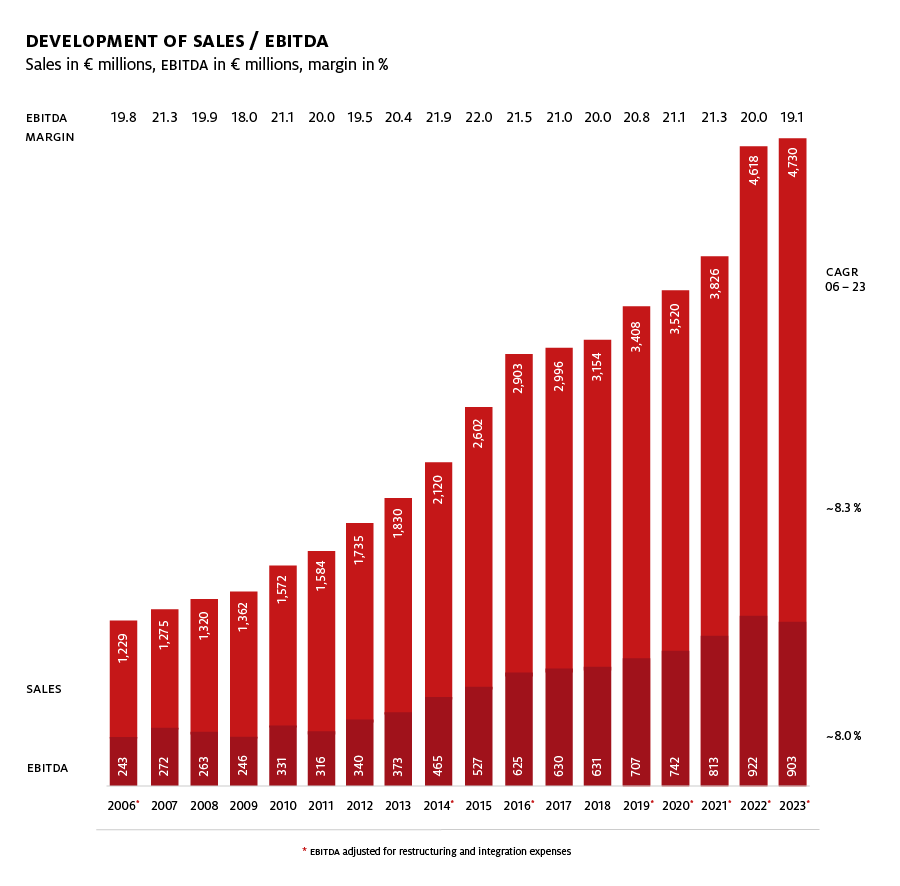

An investment in Symrise is an investment in industry-leading growth and sustainable success

Since our 2006 IPO, we’ve steadily cemented our position at the forefront of the flavor and fragrance world, while multiplying our shareholders’ return.

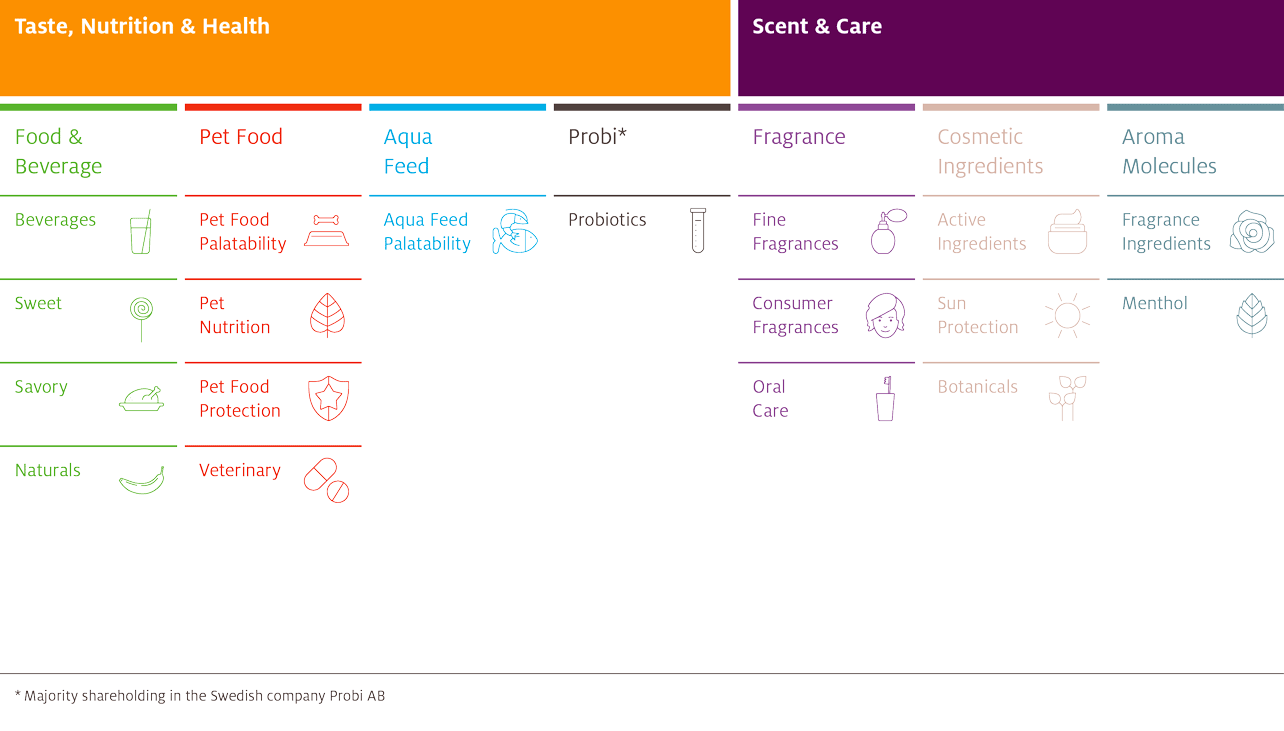

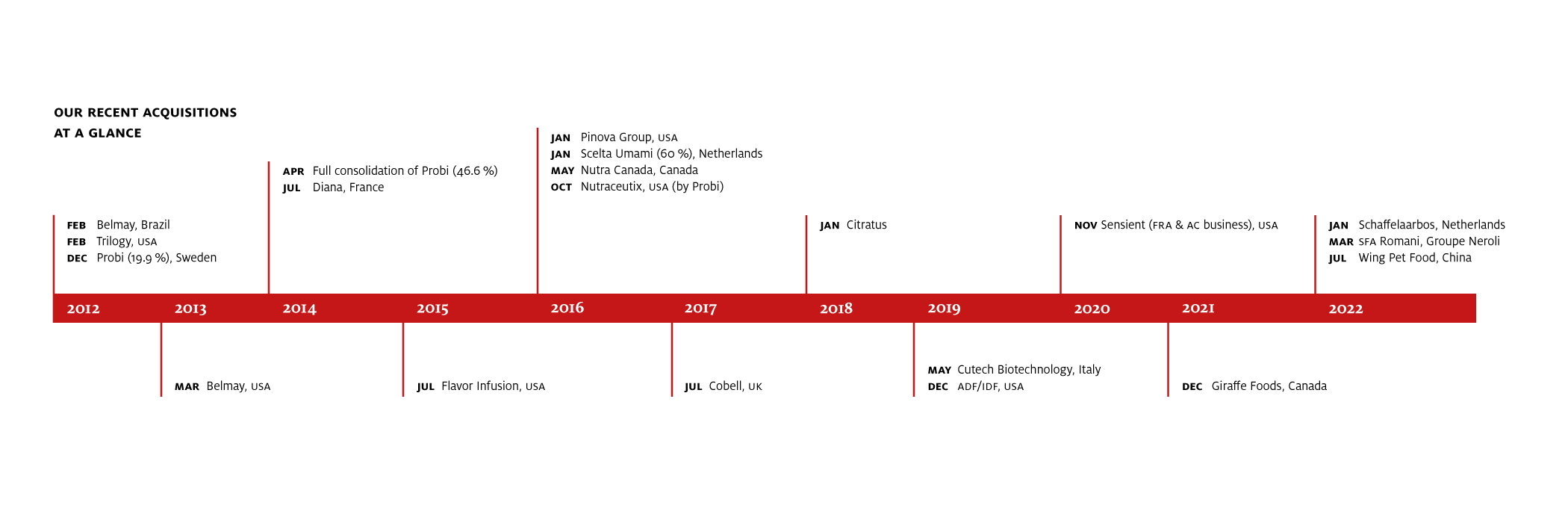

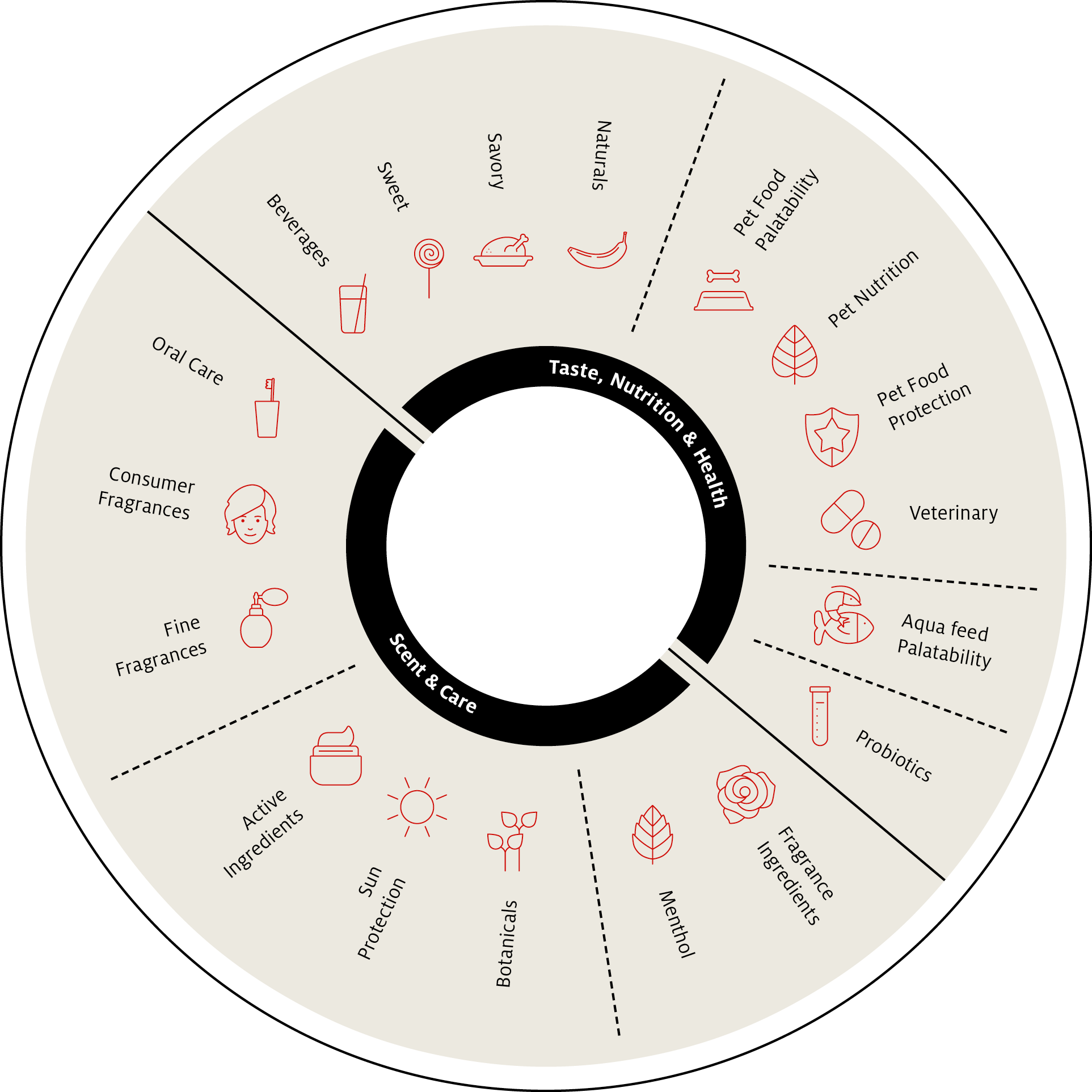

Our continual success is defined by industry-leading growth and a comprehensive portfolio beyond traditional flavor and fragrance, underpinned by a commitment to backward integration and sustainability. Today, we employ more than 11,000 people and operate more than 100 production sites across the world.

We hold market-leading positions in a number of segments – from baby and pet food to fragrance ingredients, menthol and oral care. Our overall global market share amounts to 11%.

Symrise as it’s known today was founded in 2003, when the former Bayer subsidiary, Haarmann & Reimer, merged with the family-owned Dragoco. The historic roots of our business however date back to 1874, when the founders of Haarman & Reimer discovered how to produce nature-identical vanillin from coniferous trees. Their innovation kick-started a global industry, which continues to inspire our approach today.