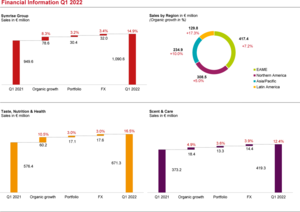

Symrise AG made a successful start to the new fiscal year. The Group increased its sales in reporting currency by 14.9 % to € 1,090.6 million (Q1 2021: € 949.6 million). Symrise benefited from the ongoing high demand and positive portfolio and currency translation effects. In organic terms, the Group posted strong sales growth of 8.3 % after the strong quarter in the previous year (10.5 %). A good business dynamic in both segments contributed to this development.

“At the start of the year, Symrise has seamlessly continued the positive business trajectory of the prior year. The ordering behavior of our customers clearly indicates that consumers have once again become more active with the reduction of many Coronavirus restrictions. This applies to travel and to areas like gastronomy and leisure. As a result, demand has increased for application areas such as sun protection and fine fragrances, as well as beverages and culinary products,” said Dr. Heinz-Jürgen Bertram, Chief Executive Officer of Symrise AG. “As the year progresses, we will see an increased level of volatility in the business environment due to the war in Ukraine and the ongoing battle against the pandemic. Nevertheless, we expect reliable demand and are convinced that we are well positioned for the coming months. We are consistently implementing our growth initiatives and continue to target organic sales growth of 5 to 7 % with an expected EBITDA margin of around 21 % for the current fiscal year.”

Scent & Care with high demand for cosmetic ingredients

Scent & Care, the fragrances, perfumery applications and cosmetic ingredients business, generated sales of € 419.3 million and grew by 12.4 % (Q1 2021: € 373.2 million) year-on-year. Sales increased organically by 4.9 %.

The Fragrances division delivered a satisfactory sales trajectory. Previously, the luxury segment had been significantly impacted by the pandemic but saw a steady recovery in the past months. Our Fine Fragrances application area benefited particularly, posting growth in the double-digit percentage range on a year-on-year basis. In the Consumer Fragrances application area, demand for hygiene and cleaning products in particular was lower than in the previous year.

The Aroma Molecules division increased sales organically in the single-digit percentage range. Notably, demand for menthol was at a high level. The division achieved highest growth in the North America and Asia/Pacific regions. However, delays in the global supply chains tended to impact the division overall.

Sales in the Cosmetic Ingredients division developed very positively during the first quarter of the current year with organic percentage growth in the double-digit range. The key growth drivers were the regions EAME (Europe, Africa, Middle East) and Latin America. In particular, the application area for sun protection products grew dynamically as a result of the increase in international travel activity and the return to more widespread leisure activities.

Taste, Nutrition & Health achieves significant growth with pet food and beverage applications

The Taste, Nutrition & Health segment, which comprises all activities relating to taste solutions for food and beverages, pet food and health solutions, increased sales by 16.5 % to € 671.3 million (Q1 2021: € 576.4 million). Organic growth reached 10.5 %. All regions contributed to this positive result. The Latin America region was by far the strongest growth driver.

In the Food & Beverage division, newly reinvigorated leisure activities and increasing out-of-home consumption led to high demand for applications in beverages and savory products. The Latin America and Asia/Pacific regions posted the strongest growth rates.

The Pet Food division continued its high double-digit percentage growth unabated, with all regions contributing to this result. By expanding capacities in China, North America, Brazil and France, Symrise has already laid the foundation for further accelerated expansion of the pet food applications business.

The targeted portfolio expansion in the Taste, Nutrition & Health segment is closely aligned with customer requirements. The recent acquisitions of Giraffe Foods in Canada, Schaffelaarbos in the Netherlands, and going forward Wing Pet Food in China are contributing to this.

Confident for the current fiscal year in spite of challenging market environment

In spite of the current volatile market environment resulting from the war between Russia and Ukraine, the global supply disruptions and the ongoing tangible impacts of the Coronavirus pandemic, Symrise considers itself well-positioned to continue its profitable growth course. The company has confidence in its robust business model, its diversified portfolio of applications and its broad regional presence and customer base.

Symrise therefore confirms its long-term growth and profitability targets and continues to expect that it will grow faster than the relevant market. The company is targeting a compound annual growth rate (CAGR) of 5 to 7 %.

Profitability is projected to be maintained at a high level for 2022 with an EBITDA margin of around 21 %. This objective also applies despite the fact that Symrise expects headwinds on the cost side from rising raw material prices. Over the medium term, Symrise is targeting an EBITDA margin in the range of 20 to 23 % until the end of fiscal year 2025.

Financial calendar

03 May

Annual General Meeting

02 August

Half Year Results January - June 2022

26 October

Interim Group Report January - September 2022 (trading update)